Featured

Table of Contents

Life insurance policy supplies 5 financial advantages for you and your family. The primary benefit of adding life insurance policy to your financial plan is that if you die, your heirs obtain a round figure, tax-free payout from the plan. They can utilize this money to pay your final costs and to replace your earnings.

Some policies pay out if you establish a chronic/terminal health problem and some supply cost savings you can make use of to support your retired life. In this write-up, find out about the different benefits of life insurance policy and why it might be a great idea to buy it. Life insurance supplies benefits while you're still to life and when you pass away.

Accidental Death

Life insurance payments generally are income-tax cost-free. Some irreversible life insurance policy policies construct cash worth, which is cash you can take out while still active.

If you have a plan (or plans) of that dimension, individuals who rely on your earnings will still have money to cover their recurring living costs. Recipients can utilize plan benefits to cover essential day-to-day costs like rental fee or home mortgage repayments, energy bills, and grocery stores. Average annual expenditures for households in 2022 were $72,967, according to the Bureau of Labor Statistics.

Life insurance policy payments aren't taken into consideration revenue for tax obligation functions, and your recipients don't have to report the money when they submit their tax returns. Depending on your state's regulations, life insurance coverage benefits may be made use of to balance out some or all of owed estate tax obligations.

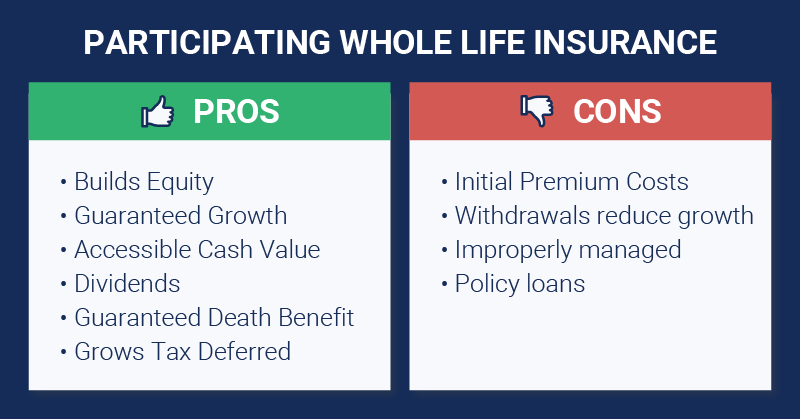

Additionally, the cash worth of whole life insurance grows tax-deferred. As the cash money value constructs up over time, you can use it to cover expenses, such as getting a car or making a down repayment on a home.

Who has the best customer service for Universal Life Insurance?

If you make a decision to borrow against your cash money value, the car loan is exempt to income tax as long as the policy is not given up. The insurer, nonetheless, will charge interest on the funding amount till you pay it back. Insurance coverage firms have varying rates of interest on these finances.

8 out of 10 Millennials overestimated the price of life insurance coverage in a 2022 study. In actuality, the typical price is closer to $200 a year. If you assume purchasing life insurance policy might be a clever monetary action for you and your family members, consider seeking advice from a financial expert to embrace it into your economic strategy.

Guaranteed Benefits

The 5 primary kinds of life insurance policy are term life, whole life, global life, variable life, and final cost protection, also called burial insurance policy. Each kind has different features and benefits. Term is a lot more affordable but has an expiry day. Whole life starts out costing extra, yet can last your entire life if you maintain paying the costs.

It can settle your debts and clinical expenses. Life insurance policy can additionally cover your home loan and supply money for your family to keep paying their costs. If you have family members depending on your earnings, you likely need life insurance coverage to sustain them after you die. Stay-at-home parents and local business owner also often require life insurance policy.

Lesser quantities are available in increments of $10,000. Under this strategy, the elected coverage takes effect two years after enrollment as long as costs are paid throughout the two-year duration.

Protection can be prolonged for up to two years if the Servicemember is totally disabled at splitting up. SGLI protection is automatic for most energetic obligation Servicemembers, Ready Book and National Guard participants scheduled to carry out at the very least 12 durations of inactive training per year, participants of the Commissioned Corps of the National Oceanic and Atmospheric Management and the Public Health and wellness Service, cadets and midshipmen of the United state

VMLI is available to Veterans who professionals a Obtained Adapted Specifically Adjusted (SAH), have title to the home, and have a mortgage on the home. All Servicemembers with full time insurance coverage ought to make use of the SGLI Online Enrollment System (SOES) to assign beneficiaries, or minimize, decline or bring back SGLI insurance coverage.

Members with part-time protection or do not have accessibility to SOES must use SGLV 8286 to make adjustments to SGLI (Premium plans). Full and data type SGLV 8714 or apply for VGLI online. All Servicemembers need to make use of SOES to decline, decrease, or restore FSGLI insurance coverage. To access SOES, most likely to www.milconnect.dmdc.osd.mil/milconnect/. Participants who do not have accessibility to SOES should use SGLV 8286A to to make modifications to FSGLI insurance coverage.

How much does Premium Plans cost?

Plan benefits are lowered by any type of exceptional car loan or loan interest and/or withdrawals. Rewards, if any kind of, are affected by plan finances and car loan rate of interest. Withdrawals over the price basis may lead to taxable average income. If the plan gaps, or is surrendered, any exceptional finances considered gain in the policy might undergo common earnings tax obligations.

If the policy owner is under 59, any kind of taxed withdrawal may likewise undergo a 10% government tax penalty. Cyclists might incur an extra cost or costs. Bikers might not be available in all states. All whole life insurance policy warranties go through the prompt settlement of all needed costs and the insurance claims paying capacity of the providing insurer.

The cash money abandonment value, funding value and death profits payable will be decreased by any type of lien impressive as a result of the repayment of a sped up advantage under this cyclist. The accelerated benefits in the initial year reflect reduction of an one-time $250 administrative fee, indexed at a rising cost of living rate of 3% annually to the price of velocity.

A Waiver of Premium biker forgoes the responsibility for the insurance policy holder to pay additional premiums need to she or he become absolutely impaired continuously for at the very least six months. This rider will incur an additional price. See policy contract for added details and requirements.

What is the most popular Death Benefits plan in 2024?

Find out a lot more concerning when to get life insurance policy. A 10-year term life insurance policy policy from eFinancial costs $2025 monthly for a healthy grownup who's 2040 years of ages. * Term life insurance policy is more budget-friendly than permanent life insurance policy, and women customers typically get a reduced price than male clients of the same age and wellness status.

Latest Posts

An Introduction to 20-year Level Term Life Insurance

Who offers Best Level Term Life Insurance?

How Does Voluntary Term Life Insurance Policy Work?