Featured

Table of Contents

That normally makes them an extra inexpensive option for life insurance protection. Several individuals obtain life insurance protection to assist monetarily safeguard their enjoyed ones in case of their unanticipated fatality.

Or you may have the option to convert your existing term protection right into a long-term policy that lasts the remainder of your life. Various life insurance plans have possible benefits and disadvantages, so it's essential to recognize each before you make a decision to acquire a plan.

As long as you pay the costs, your recipients will certainly receive the survivor benefit if you die while covered. That stated, it is very important to note that the majority of plans are contestable for two years which implies protection can be rescinded on fatality, must a misrepresentation be discovered in the application. Plans that are not contestable typically have a graded survivor benefit.

What is Simplified Term Life Insurance? Understanding Its Purpose?

Premiums are typically reduced than whole life plans. You're not secured right into an agreement for the remainder of your life.

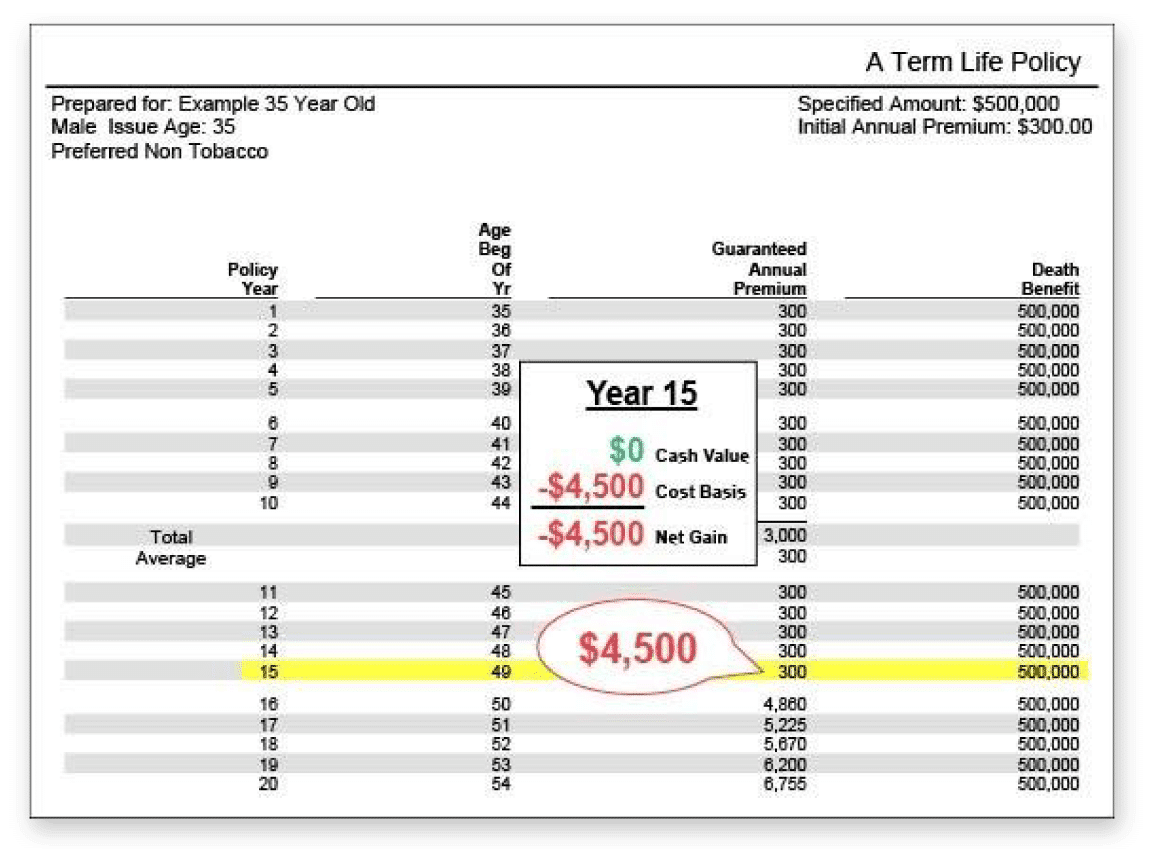

And you can't pay out your plan throughout its term, so you will not receive any economic advantage from your past insurance coverage. As with other kinds of life insurance coverage, the price of a degree term plan relies on your age, protection requirements, employment, lifestyle and health. Normally, you'll find a lot more inexpensive protection if you're younger, healthier and less high-risk to guarantee.

Considering that degree term costs stay the same throughout of protection, you'll recognize specifically just how much you'll pay each time. That can be a large assistance when budgeting your costs. Level term coverage likewise has some versatility, allowing you to customize your policy with added functions. These frequently can be found in the type of cyclists.

What is Decreasing Term Life Insurance? The Key Points?

You may have to fulfill particular problems and credentials for your insurance company to establish this biker. Furthermore, there may be a waiting duration of approximately six months prior to taking effect. There also can be an age or time limit on the insurance coverage. You can include a youngster motorcyclist to your life insurance coverage policy so it also covers your children.

The death advantage is generally smaller, and coverage normally lasts up until your child turns 18 or 25. This motorcyclist might be an extra cost-efficient means to aid ensure your kids are covered as bikers can typically cover numerous dependents simultaneously. Once your youngster ages out of this insurance coverage, it may be feasible to convert the rider into a brand-new policy.

The most usual type of long-term life insurance policy is entire life insurance, but it has some crucial differences compared to level term protection. Here's a fundamental introduction of what to take into consideration when comparing term vs.

What Are the Terms in Annual Renewable Term Life Insurance?

Whole life insurance lasts insurance coverage life, while term coverage lasts protection a specific periodParticular The costs for term life insurance are typically reduced than whole life insurance coverage.

Among the primary attributes of degree term protection is that your costs and your death advantage do not alter. With decreasing term life insurance policy, your costs continue to be the exact same; nonetheless, the survivor benefit quantity obtains smaller sized over time. For instance, you might have protection that starts with a fatality benefit of $10,000, which could cover a mortgage, and after that annually, the survivor benefit will certainly reduce by a collection quantity or portion.

Due to this, it's frequently an extra budget friendly kind of degree term protection., however it may not be adequate life insurance policy for your needs.

What is Life Insurance Level Term? Detailed Insights?

After deciding on a plan, complete the application. If you're accepted, authorize the documents and pay your initial costs.

You might desire to update your beneficiary details if you've had any type of considerable life adjustments, such as a marriage, birth or separation. Life insurance coverage can in some cases really feel challenging.

No, degree term life insurance coverage doesn't have money value. Some life insurance plans have a financial investment attribute that allows you to build money worth with time. A section of your premium repayments is set aside and can gain passion over time, which expands tax-deferred throughout the life of your protection.

Nevertheless, these plans are typically significantly a lot more expensive than term coverage. If you get to the end of your policy and are still alive, the coverage finishes. Nevertheless, you have some choices if you still desire some life insurance policy protection. You can: If you're 65 and your coverage has actually run out, for instance, you may intend to buy a brand-new 10-year level term life insurance coverage policy.

What is Life Insurance? Comprehensive Guide

You might be able to convert your term coverage right into a whole life plan that will last for the rest of your life. Lots of kinds of level term plans are convertible. That suggests, at the end of your coverage, you can transform some or all of your policy to entire life insurance coverage.

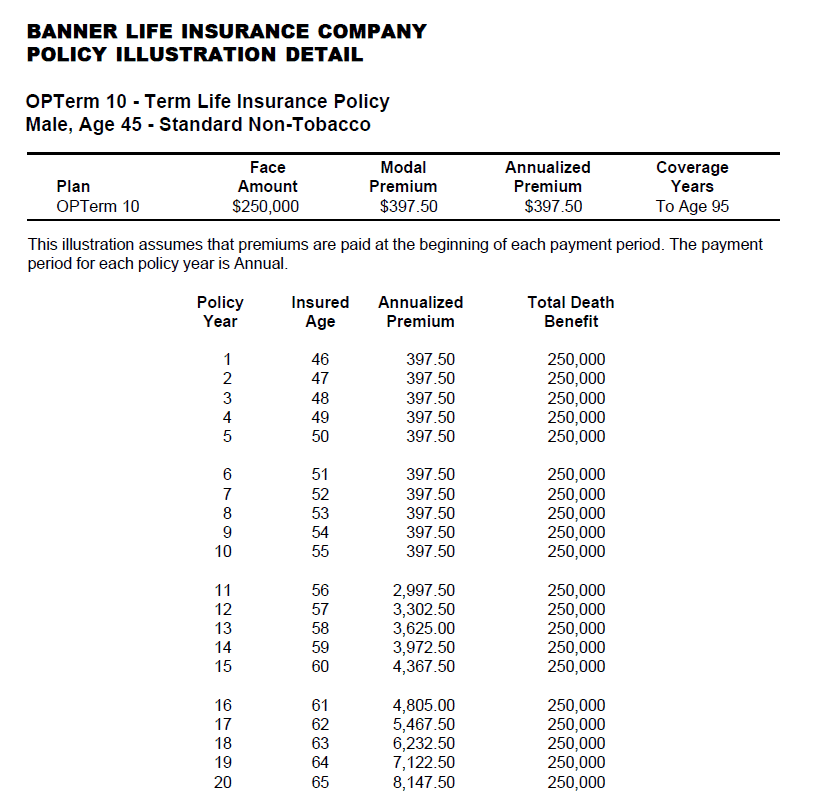

A level premium term life insurance strategy allows you adhere to your spending plan while you help protect your family. Unlike some tipped price strategies that raises annually with your age, this type of term strategy supplies prices that stay the exact same through you pick, even as you grow older or your health and wellness changes.

Discover a lot more concerning the Life insurance policy alternatives offered to you as an AICPA member (Term Life Insurance). ___ Aon Insurance Solutions is the brand for the brokerage firm and program management procedures of Fondness Insurance Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Agency, Inc. (CA 0795465); in OK, AIS Fondness Insurance Solutions Inc.; in CA, Aon Fondness Insurance Policy Services, Inc .

Latest Posts

Funeral Plan Cover

Does Life Insurance Pay Funeral Costs

Instant Approval Life Insurance