Featured

Table of Contents

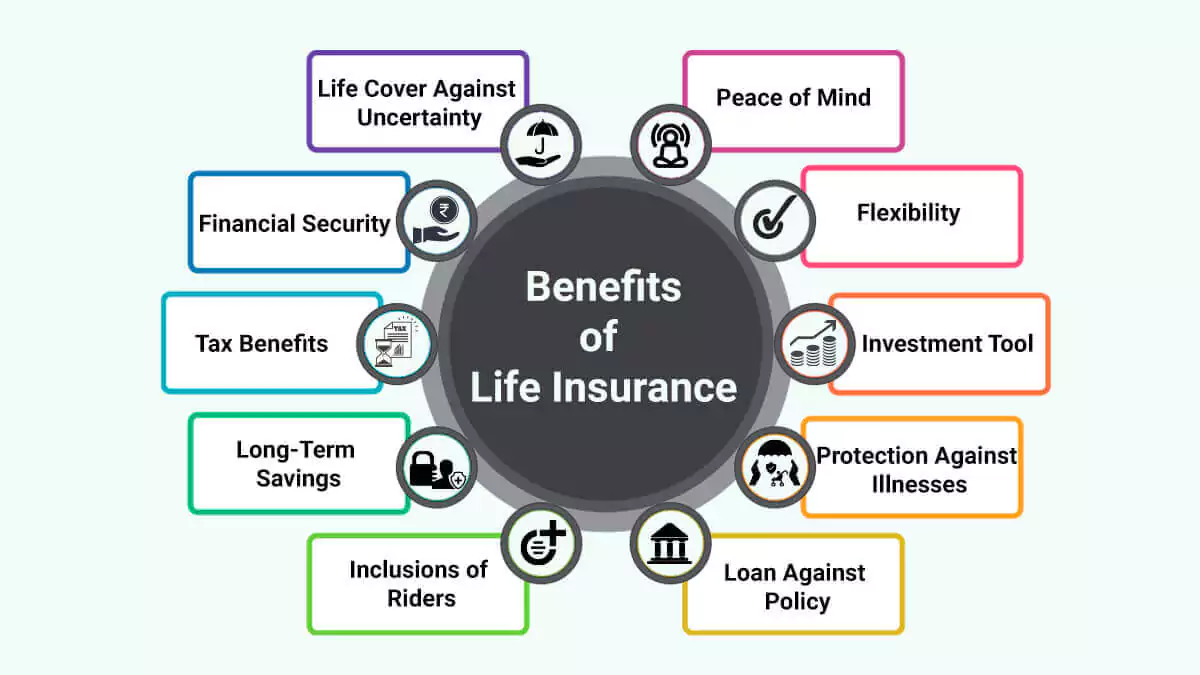

Life insurance policy covers the guaranteed person's life. If you pass away while your plan is active, your recipients can use the payout to cover whatever they pick clinical costs, funeral expenses, education and learning, fundings, everyday costs, and even financial savings.

Depending on the problem, it may impact the policy type, rate, and protection amount an insurance company uses you. Life insurance policy plans can be classified into 3 major teams, based on exactly how they work:.

What are the benefits of Legacy Planning?

OGB supplies 2 fully-insured life insurance strategies for staff members and retirees with. The state pays half of the life insurance policy costs for covered workers and retirees. Both strategies of life insurance readily available, along with the matching quantities of reliant life insurance policy supplied under each strategy, are noted below.

Term Life insurance policy is a pure transference of risk in exchange for the repayment of costs. Prudential, and prior carriers, have actually been giving protection and thinking risk for the payment of premium. In the event a covered person were to pass, Prudential would certainly honor their obligation/contract and pay the benefit.

Plan participants currently enrolled who want to add dependent life coverage for a partner can do so by providing proof of insurability. Employee pays 100 percent of dependent life premiums.

Contract Series: 83500. 2018 Prudential Financial, Inc. and its associated entities. Prudential, the Prudential logo, the Rock icon, and Bring Your Obstacles are solution marks of Prudential Financial, Inc. and its related entities, registered in numerous territories worldwide. 1013266-00001-00.

Flexible Premiums

The rate structure allows employees, partners and cohabitants to pay for their insurance policy based on their ages and chosen coverage amount(s). The optimum ensured issuance amount offered within 60 days of your hire day, without proof of insurability is 5 times your base yearly salary or $1,000,000, whichever is less.

While every effort has been made to make sure the precision of this Summary, in case of any kind of discrepancy the Recap Plan Summary and Plan Record will dominate.

What happens when the unexpected comes at you while you're still alive? Unexpected health problems, long-term handicaps, and much more can strike without caution and you'll wish to be ready. You'll intend to make certain you have options available simply in case. The good news is for you, a lot of life insurance coverage policies with living advantages can provide you with monetary assistance while you're to life, when you require it one of the most.

On the various other hand, there are permanent life insurance policy policies. These plans are commonly much more pricey and you'll likely have to go with medical examinations, yet the advantages that come with it belong to the reason for this. You can add living benefits to these plans, and they have cash money value growth potential gradually, indicating you might have a few different options to utilize in instance you need moneying while you're still alive. Policyholders.

What are the benefits of Cash Value Plans?

These policies might allow you to add particular living benefits while also allowing your strategy to accrue money worth that you can withdraw and utilize when you need to. is similar to entire life insurance policy because it's a long-term life insurance coverage policy that implies you can be covered for the rest of your life while delighting in a policy with living advantages.

When you pay your premiums for these policies, component of the payment is diverted to the cash value. This money value can grow at either a dealt with or variable price as time progresses relying on the kind of policy you have. It's this amount that you may be able to gain access to in times of requirement while you're alive.

Nonetheless, they'll accrue interest fees that can be harmful to your death advantages. Withdrawals let you withdraw cash from the cash value you've collected without rate of interest charges. The downside to utilizing a withdrawal is that it can raise your premium or lower your death advantage. Giving up a plan basically indicates you have actually ended your policy outright, and it immediately offers you the cash worth that had built up, less any type of surrender costs and outstanding plan costs.

Making use of cash money worth to pay costs is essentially just what it appears like. Depending on the type of policy, you can use the cash value that you have accrued with your life insurance plan to pay a portion or all your premiums.

What is the process for getting Family Protection?

The terms and amount offered will be specified in the policy. Any type of living advantage paid from the survivor benefit will decrease the quantity payable to your recipient (Death benefits). This payout is indicated to assist provide you with convenience for the end of your life along with aid with clinical expenses

Critical health problem motorcyclist guarantees that benefits are paid directly to you to pay for therapy services for the disease defined in your policy contract. Lasting care riders are established to cover the expense of in-home treatment or assisted living home costs as you age. A life settlement is the procedure through which you sell a life insurance policy plan to a third party for a round figure payment.

Where can I find Life Insurance Plans?

:max_bytes(150000):strip_icc()/dotdash-variable_universal-Final-66a32d4c8d84418ab1271e02d73d2a4b.jpg)

That depends. If you're in a long-term life insurance policy plan, after that you have the ability to withdraw cash money while you're to life with loans, withdrawals, or surrendering the plan. Prior to making a decision to tap into your life insurance policy policy for money, consult an insurance policy representative or representative to establish how it will certainly affect your recipients after your fatality.

All life insurance plans have something in common they're developed to pay cash to "called beneficiaries" when you pass away. Living benefits. The beneficiaries can be several individuals or perhaps an organization. In many cases, plans are purchased by the individual whose life is guaranteed. Life insurance policy policies can be taken out by spouses or any person who is able to show they have an insurable interest in the individual.

Is Life Insurance Plans worth it?

The policy pays money to the called recipients if the insured passes away during the term. Term life insurance policy is meant to supply lower-cost insurance coverage for a specific period, like a ten year or 20-year period. Term life policies may consist of a stipulation that enables protection to proceed (renew) at the end of the term, also if your health status has actually changed.

Ask what the premiums will certainly be prior to you restore. If the policy is non-renewable you will need to use for insurance coverage at the end of the term.

Latest Posts

Funeral Plan Cover

Does Life Insurance Pay Funeral Costs

Instant Approval Life Insurance