Featured

Table of Contents

- – What is the Difference with Joint Term Life In...

- – The Essentials: What is Term Life Insurance Wi...

- – What is Level Term Life Insurance Definition?...

- – Understanding the Benefits of 20-year Level T...

- – What is Level Term Vs Decreasing Term Life I...

- – What is Simplified Term Life Insurance? Pros...

If George is identified with a terminal health problem during the very first plan term, he probably will not be qualified to restore the plan when it runs out. Some plans supply guaranteed re-insurability (without proof of insurability), however such attributes come with a higher price. There are several types of term life insurance policy.

The majority of term life insurance has a level premium, and it's the type we've been referring to in many of this write-up.

Term life insurance is eye-catching to youngsters with youngsters. Parents can obtain substantial coverage for a low price, and if the insured passes away while the policy holds, the family members can depend on the death benefit to replace lost income. These policies are also fit for individuals with expanding families.

What is the Difference with Joint Term Life Insurance?

The best option for you will depend upon your needs. Here are some things to think about. Term life policies are optimal for people that desire substantial insurance coverage at a reduced expense. Individuals who possess whole life insurance policy pay a lot more in premiums for much less insurance coverage yet have the protection of recognizing they are secured forever.

The conversion cyclist should permit you to convert to any long-term plan the insurance policy business offers without limitations. The primary attributes of the rider are keeping the initial wellness rating of the term plan upon conversion (also if you later on have health and wellness issues or become uninsurable) and choosing when and just how much of the coverage to convert.

Of program, total costs will increase dramatically considering that entire life insurance coverage is a lot more pricey than term life insurance. Medical problems that create during the term life duration can not create premiums to be boosted.

The Essentials: What is Term Life Insurance With Level Premiums?

Term life insurance coverage is a reasonably cost-effective means to supply a round figure to your dependents if something occurs to you. It can be an excellent option if you are young and healthy and balanced and support a family members. Whole life insurance policy comes with significantly greater monthly premiums. It is meant to supply insurance coverage for as long as you live.

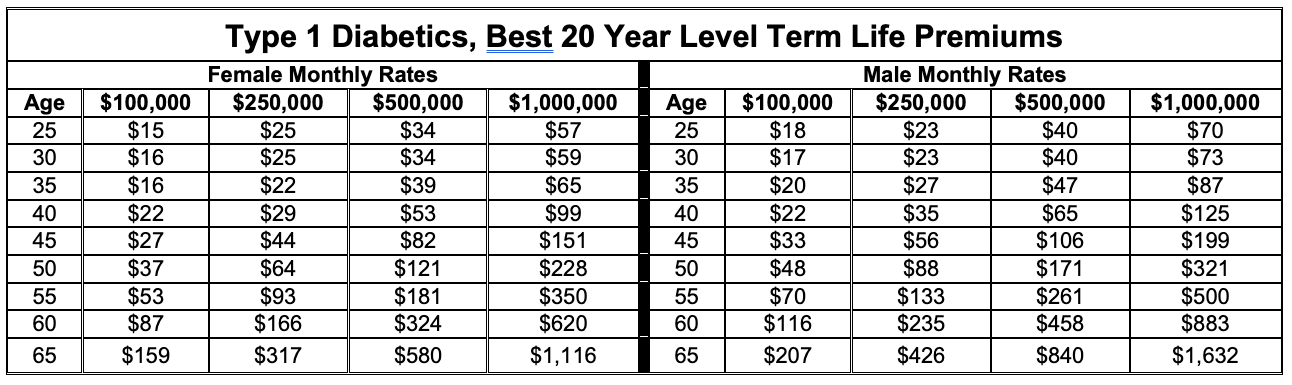

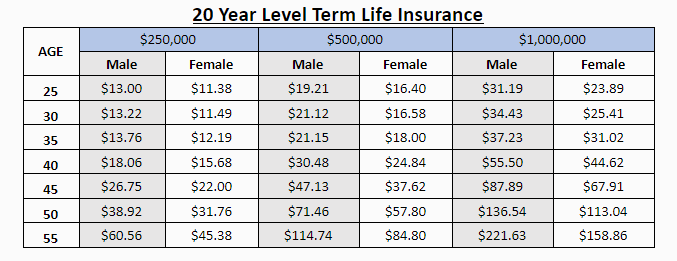

It depends upon their age. Insurance provider established a maximum age limitation for term life insurance policy plans. This is generally 80 to 90 years of ages but might be greater or lower relying on the firm. The costs additionally climbs with age, so an individual aged 60 or 70 will certainly pay considerably greater than somebody decades more youthful.

Term life is somewhat comparable to vehicle insurance policy. It's statistically not likely that you'll need it, and the costs are money down the drain if you do not. Yet if the worst occurs, your family will get the benefits (Level premium term life insurance policies).

What is Level Term Life Insurance Definition? Key Points to Consider?

For the a lot of part, there are 2 kinds of life insurance strategies - either term or long-term plans or some mix of both. Life insurers provide various kinds of term plans and standard life plans in addition to "interest sensitive" products which have actually become much more widespread because the 1980's.

Term insurance policy gives security for a given time period. This duration might be as brief as one year or give insurance coverage for a details variety of years such as 5, 10, twenty years or to a specified age such as 80 or in many cases up to the earliest age in the life insurance policy mortality.

Understanding the Benefits of 20-year Level Term Life Insurance

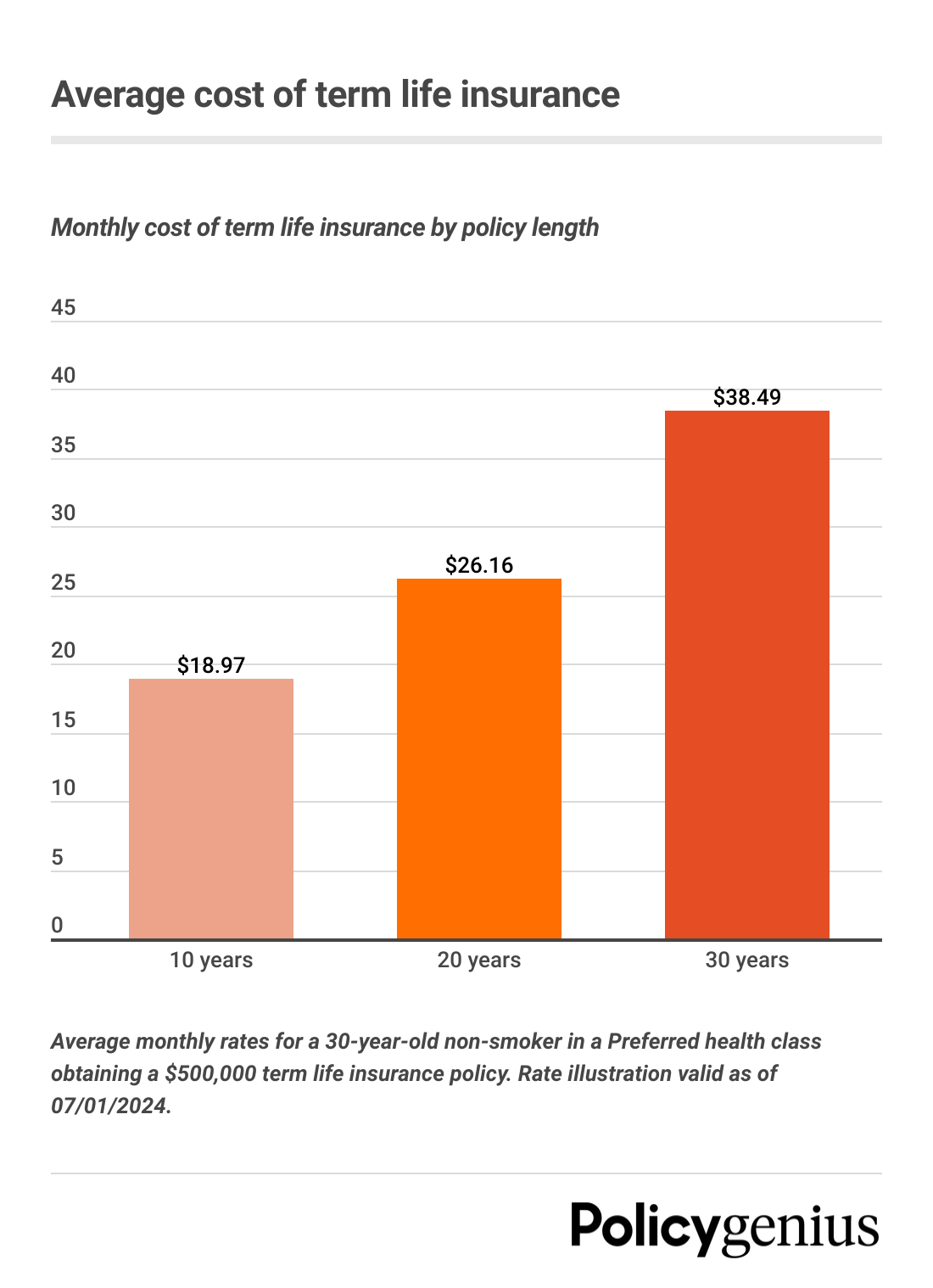

Presently term insurance prices are extremely affordable and amongst the most affordable historically experienced. It must be kept in mind that it is an extensively held belief that term insurance coverage is the least pricey pure life insurance policy coverage available. One requires to examine the policy terms carefully to decide which term life choices are ideal to satisfy your particular situations.

With each new term the costs is increased. The right to renew the policy without evidence of insurability is an important advantage to you. Or else, the threat you take is that your health and wellness may wear away and you might be incapable to obtain a plan at the very same prices and even in any way, leaving you and your beneficiaries without insurance coverage.

You have to exercise this alternative during the conversion period. The size of the conversion duration will vary depending upon the sort of term policy acquired. If you convert within the recommended period, you are not needed to offer any type of info about your health and wellness. The costs price you pay on conversion is generally based on your "present obtained age", which is your age on the conversion day.

Under a level term plan the face quantity of the policy stays the very same for the entire period. With lowering term the face quantity minimizes over the duration. The costs stays the same annually. Typically such plans are offered as home loan protection with the quantity of insurance decreasing as the balance of the home loan lowers.

Typically, insurance providers have not deserved to alter premiums after the policy is offered. Given that such plans might proceed for several years, insurance companies should make use of conservative death, interest and expense price quotes in the costs estimation. Flexible costs insurance policy, nonetheless, enables insurance companies to provide insurance coverage at reduced "present" costs based upon much less conventional presumptions with the right to transform these costs in the future.

What is Level Term Vs Decreasing Term Life Insurance? Key Facts

While term insurance policy is designed to supply defense for a specified period, long-term insurance is designed to provide protection for your entire life time. To keep the premium price degree, the costs at the more youthful ages goes beyond the actual price of protection. This added costs develops a reserve (cash money worth) which assists spend for the plan in later years as the cost of security rises above the premium.

The insurance coverage business invests the excess costs dollars This type of plan, which is in some cases called cash value life insurance policy, generates a savings aspect. Cash money worths are crucial to an irreversible life insurance coverage plan.

Occasionally, there is no relationship in between the size of the cash money worth and the premiums paid. It is the money value of the plan that can be accessed while the insurance policy holder lives. The Commissioners 1980 Standard Ordinary Mortality Table (CSO) is the present table utilized in determining minimal nonforfeiture worths and plan gets for ordinary life insurance policy policies.

What is Simplified Term Life Insurance? Pros and Cons

Several irreversible policies will consist of stipulations, which specify these tax obligation needs. Conventional entire life policies are based upon long-term quotes of expenditure, passion and death.

Table of Contents

- – What is the Difference with Joint Term Life In...

- – The Essentials: What is Term Life Insurance Wi...

- – What is Level Term Life Insurance Definition?...

- – Understanding the Benefits of 20-year Level T...

- – What is Level Term Vs Decreasing Term Life I...

- – What is Simplified Term Life Insurance? Pros...

Latest Posts

Funeral Plan Cover

Does Life Insurance Pay Funeral Costs

Instant Approval Life Insurance

More

Latest Posts

Funeral Plan Cover

Does Life Insurance Pay Funeral Costs

Instant Approval Life Insurance